Take two traders. Give them the same starting capital, the same trading platform, the same market, and the same trading system with precise rules for entry and exit. Come back a month later and what will you find? One trader will be up 20%. The other will be down 40%. It's fascinating, isn't it, how two people can have the same opportunities in life, and yet get very different results. We at www.wintradersfot.com firmly believe that the answer to success lies within each of us; and that we are each completely responsible for our own results in the market. The following top 10 lists were compiled from the many discussions that take place at our regular traders’ feedback in NSE, MCX and FOREX. We try to be useful the below details to you, some of it you'll already know... some of it will be new. UNDERSTAND THE TRUTH Trading…

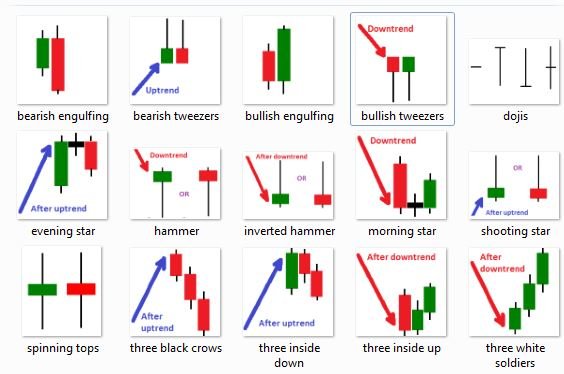

Japanese Candlestick lines and charts Traditional Japanese charts whose individual lines look like candles, hence their name. The candlestick line is comprised of a real body and shadows. See "Real body" and "shadow." 1. Belt-hold line Belt-hold line - there are bullish and bearish belt holds. A bullish belt hold is a tall white candlestick that opens on its low. It is also called a white opening-shaven bottom. At a low price area, this is a bullish signal. A bearish belt hold is a long black candlestick that opens on its high. Also referred to as a black opening-shaven head. At a high price level, it is considered bearish 2. Counterattack Lines Counterattack lines -- following a black (white) candlestick in a downtrend (uptrend), the market gaps sharply lower (higher) on the opening and then closes unchanged from the prior session's close. A pattern that reflects a stalemate between the…

Best Performing Stock / Commodity Market Charting Software in India Win Trader, now completed 11 years of successful journey and we are proud that we could make many traders (MCX, NSE, FOREX) successful in day trading. Before launching the first version of Win Trader, we were traders for more than 10 years, at the starting of our trading, as usual like every other traders faced, we failed, we lost the capital, we panicked. But some how we managed the losses and plan to study each and every aspect of day trading and technical analysis. We do lot of home work, and trial test with our own investment some one failed, some one succeeded, but with no consistency in profit, in log term its not beneficial for trading, after the so may fails and tries finally we got a golden combination and formula that makes consistent profit in day trading in…

WinTrader, The best selling BUY SELL signal Software Ready to launch the most awaiting version of WinTrader Trading Systems Series. Version Details: Trading System: WinTrader V8.0, Scanner: WinTrader Scanner 1.1 WinTrader V8.0 comes with easy to use interface, that each and every detail will display on the screen, see the attached screenshot of WinTrader V8.0. WinTrader V8.0 Screen Shot: WinTrader Scanner 1.1

Stock trading is a very wonderful and interesting game. Winning secrets behind stock trading are perspective, discipline, and self-control of emotions. There are thousands of stocks available in the market. The news about all these stocks available through TV, Radio, and other media. All these news force investors to take emotional decisions. Chasing the stock is not good because sometimes you fail to buy at the correct point. TV news always displays the details of major stocks. Some news attracts you and you take certain decision to buy it. But what happened at that level is? The entry may be a late entry. Those who continuously sit in front of the PC or Tape do this kind of common mistakes. So channel monitoring leads you to a dangerous decision taking situation. Before buying a rising stock, always refer a weekly chart to identify if that stock is building a base…

Looking into any field you can see two types of people. One is successful people and the other is unsuccessful. Actually, what is the difference between the two? Successful people are willing to do all the things what others are unwilling to do. But in any field anyone can made mistakes. Even in your day to day life you made many mistakes. So no matter, whether you are a small investor, inexperienced beginners or smart professionals. There is chance to made mistakes. And they lose money. You just have to do is “Build up your weaknesses until they become your strong points”. “Concentrate on your strengths, not your weaknesses” This is the logic. Successful traders are risk takers not large risk but less risk. 98% of all investors make mistakes because they don’t spend enough time in live market to learn where they made mistakes in trading stocks. You…

First we have to discuss about stop loss and then the trailing stop loss. The stop loss is mandatory functional key points that are used while trading. A stop-loss order helps you to protect your profit and limit your losses. Some of the traders are not believe in stop loss because of their fear. They are not put stop loss properly. But we cannot predict the nature of a particular trade if u don’t place the stop loss correctly it may give you a huge loss so it’s better to set the stop loss value. A stop-loss is an order to sell a security when it reaches a given price. Stop-loss sell order is designed to limit an investor's stop loss on a particular stock. The stop loss can be divided into two categories. Trailing stop loss and manual stop loss. The manual stop loss can be placed by our own view according to the market movements in…

Did you ever think why we are learning road rules before drive a car.?Yes we need to avoid the crashes. If you are in the wrong side definitely there is a chance to crush. Each trader is drivers they are driving their future through the trade, so they should follow some certain rules to go properly. Every trader was a loss trader at their earlier. Means the fault in trading usually happen in the starting time. Why it happens…? Because we have to fall first then we learn how to stand. But there is common reason for their failure, that is, every traders entering in to trade without sufficient knowledge about trade. Sometimes they might lucky and be successful for a while. In the life of every human the luck factor will come ones. But as a trader if you wait for the luck again definitely you will be…

In the option market call option have no existence without put option. Put option enable you to sell the underlying index or stock at a predetermined price in future on or before a particular expiry date. Call option and Put option are opposite to each other. But they have some similar characteristics also. The expiry date and strike price of put option is also predetermined by the stock exchange. Unlike call option a put option helps you to fix the selling price. If you expect a possible decline in the future for an underlying asset then you can fix selling price for your put option. To avoid losses pay a simple premium amount. We use put option under bearish market conditions. American put option and European put option are the two different kinds of put options. American option allows you to settle the trade before expiry of the contract. It…

In the derivative market two types of options are available, the call options and the put options. Call options are contracts which enable you to buy at a specific price in future. Similarly put options are those contracts which enable you to sell at a fixed price in the future. First we can discuss about how call option work in derivative market. Call option In call option, you can buy a certain amount of shares or an index, at a predetermined price, on or before the expiry date. This predetermined price is also known as the strike price or exercise price. Expiry date is the date before which you can handle your position. For availing this facility, you have to pay a minimum amount to the seller/writer of the option in the exchange. This is necessary for minimizing loss of a seller/writer. This is essential because the writer of the…

Keep in mind the following things before thinking about profiting in bullish and bearish market. First create a favourable group of stocks which can give you potential profit. Concentrate mainly on buy in stocks which shows continuation-type buy patterns and do reverse for the bear market. Before entering an order set a protective stoploss. If the market is so far then it is better to look for another stock or wait for a safer level to purchase. Traders should always be aware about the four stages of market. That is basing area, Advancing phase, top area, and declining phase. Basing area and Advancing phase is not suitable for sell similarly top area and declining phase is not suitable for buy. Always go with message being supplied by technical approach if there any conflict between price volume action and the earnings. Always keep monitoring your self performance by note down…

We are living in the web city. In this web city everyone is connected through internet. Nowadays everything is possible through our one touch in one minute. But how it is possible? In my early times I also ask the same question to myself. Answer is simple be a smart worker than hard worker. The world of technology is waiting for you with many opportunities. Technology has a great influence on trading. When our finger moves with our ideas it is sure you are in great success. As you know trading is a wonderful opportunity to earn handsome income within the home. At the first stage trading is look like an ocean. We got confused how to throw a stone in to it. In such a situation you will be in a dilemma. Don’t bother about it. One thing is always with you for proper guidance that is technology.…

It is every traders dream to quit his job and make a living with trading from home. There will be no boss and will be lots of money and time. In your current job you may work for long hours. After this long time commitment and back home, it may left you totally drained.At that time think about take trading as a full time job. In today’s market trading is not a high barrier-to-entry field, one who has ambition and patience can trade and can take it for a living. Nowadays anyone can start trading with little to no money. Due to changes in technology and increasing volumes on the exchanges convert the high-barrier-entry field of trading into the low-barrier-entry field. There are two cases, requirement of a small amount of personal capital to get started the trading carrier and the other is no personal capital requirement. Anyone in…

Why are traders demanding for scanning facilities in Technical Analysis Software, whether this facility is good or bad for trading success? Making money from trading is not an easy part or get quick rich scheme. Making profit from trading needs proper planning, financial management and proper tool for technical analysis particularly for day trading. But the majority of people who are trading or enter into trading professions with the prejudiced mind of making money from trading is an easy part. Don’t you ever think about that, if making consistent profit from trading is easy, then everyone will be rich in no time? The truth is only 5 to 10% of traders are making consistent profit from trading because of that they are called Professional traders. So what are the specialties in Professional traders that we don’t have to make success in trading? Suppose consider two traders, and two traders have…

As a trader you know the importance of risk and reward. Risk and reward is directly proportional. More risk means more reward. Actually risk is the sum of your work that you did or plan to do for your trade. The risk is determined by the terms of stop loss order. The difference between your entry point and your stop loss order is your risk in trade. Here a common question will arise in the mind of many. How can you calculate your risk and reward ratio? It is simple by placing the stop loss in a logical way in your chart according with your strategy. Keep one thing in your mind. Don’t choose your stop loss and target randomly. If you choose them randomly, it is dam sure that you will be in loss. That’s why the experts or the professional traders take more care in their execution…